401k, IRA & ROTH Rollovers

Are you considering rolling over your 401k to an IRA or converting to a ROTH IRA? The decision can be overwhelming and it’s important to make the right choice for your financial future. That’s where independent financial advisers can help.

Comprehensive Assessment for a Clear Financial Picture

-

In-Depth Financial Review: This process begins with a thorough assessment of your financial landscape. It includes analyzing your income, expenses, liabilities, and financial goals, ensuring a holistic approach to your retirement planning.

-

401k Plan/IRA Analysis: While IRA accounts usually offer greater flexibility than 401k plans, it’s not always a straightforward choice. Your financial adviser will meticulously review your current 401k plan and IRAs to determine the potential advantages of staying within the plan versus rolling over.

Strategic Asset Allocation for Optimal Portfolio Balance

-

Customized Asset Mix: Whether you decide on a 401k to IRA rollover or choose to retain your existing plan, your financial adviser will guide you in determining the optimal asset allocation for your portfolio, taking into account your risk tolerance, investment horizon, and financial goals.

-

Roth vs. Regular IRA Analysis: A critical part of this review is understanding the benefits and considerations of a Roth IRA versus a Traditional IRA. Often, the long-term tax advantages of a Roth IRA significantly outweigh any short-term drawbacks.

Seamless Rollover Assistance and Ongoing Management

-

Rollover Facilitation: If you opt to rollover your 401k to an IRA, a financial adviser will assist in selecting an appropriate IRA provider and manage the rollover process, ensuring a smooth transition without unintended tax implications.

-

Optional Continued Investment Management: Should you wish, your independent financial adviser can continue to manage your investments post-rollover, focusing on achieving returns that resonate with your financial goals and risk tolerance.

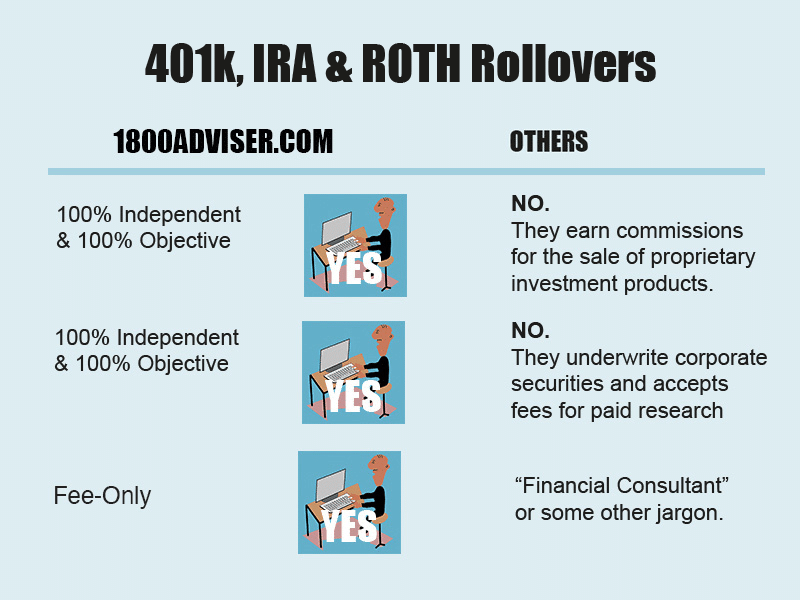

Independent & Objective “Fee-Only” Advice

Professionals listed in the 1800ADVISER.COM directory are “Fee-Only,” and we consider them to be 100% Independent & 100% Objective™. In simpler terms, this means that these professionals do not charge commissions for their advice and are not incentivized to sell any particular products. Instead, their focus is on providing honest recommendations that are in your best interest.

Fair and Reasonable Pricing

Each independent professional sets their own pricing structure, with fees for 401(K), IRA and rollover assistance starting as low as $100 per hours with many fixed-fee arrangements available. Some professionals may offer a full credit for this fee should you decide to continue with optional ongoing money management. Others may even offer 401(K), IRA and rollover assistance pro bono, or for free. Rest assured, all fees are clearly discussed and agreed upon in advance, in writing.

Free Consultations

Click here to ask us a question or schedule a FREE consultation. Alternatively, you can browse the biographies of our individual advisers on 1800ADVISER.COM. Choose the adviser that aligns with your financial aspirations and take the first step towards an empowered financial future.

All questions answered privately by email.

Connect with a Fee-Only financial planner, money manager, CPA or lawyer.

Sign up for TheAdviser.com Alert – a Trusted Buy-Side Research Newsletter For FREE!