Retirement Planning

Retirement is not just a phase of life; it’s a culmination of years of hard work, dreams, and planning. Our retirement planning services are designed to ensure that your golden years are as fulfilling and secure as you’ve always envisioned.

Tailored Strategies for Diverse Needs

- Personalized Retirement Roadmaps: Financial advisers can create personalized retirement plans that consider your current financial situation, future aspirations, and lifestyle preferences. This approach helps develop a roadmap that aligns with your specific retirement goals.

- Income Planning and Management: Understanding your future income needs is crucial. Advisers will assess various income sources, including pensions, Social Security benefits, and personal savings, to ensure a steady income stream during retirement.

- Investment Optimization for Retirement: Strategic investment is key to a successful retirement. Advisers will guide you in optimizing your investment portfolio, focusing on a balance between growth and risk management, tailored to your retirement timeline.

- Estate and Tax Planning Integration: Retirement planning is incomplete without considering estate and tax implications.

Start Planning Today for a Better Tomorrow

Whether you are years away from retirement or nearing this significant milestone, it’s never too early or too late to start planning. A customized retirement plan will help you optimize your investment strategy and guide you every step of the way, helping you answer questions like:

- Can I retire and maintain my current lifestyle?

- Should I collect Social Security early or defer payments?

- Have I saved enough for my retirement? If not, how much more do I need to save?

- Should I transfer my money to a ROTH IRA?

- How long will my retirement savings last?

- How exactly does Medicare work?

- What taxes will my estate pay?

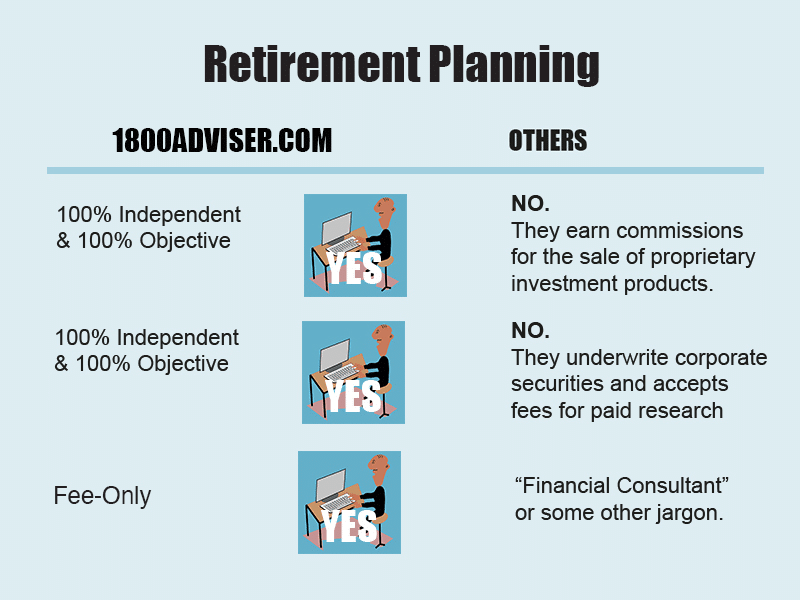

Independent & Objective “Fee-Only” Advice

Professionals listed in the 1800ADVISER.COM directory are “Fee-Only,” and we consider them to be 100% Independent & 100% Objective™. In simpler terms, this means that these professionals do not charge commissions for their advice and are not incentivized to sell any particular products. Instead, their focus is on providing honest recommendations that are in your best interest.

Free Consultations

Click here to ask us a question or schedule a FREE consultation. Alternatively, you can browse the biographies of our individual advisers on 1800ADVISER.COM. Choose the adviser that aligns with your financial aspirations and take the first step towards an empowered financial future.

All questions answered privately by email.

Connect with a Fee-Only financial planner, money manager, CPA or lawyer.

Sign up for TheAdviser.com Alert – a Trusted Buy-Side Research Newsletter For FREE!