Financial Planning

Every individual has unique circumstances and objectives. As such, there is nothing better than having a financial plan or roadmap to help guide you to achieve your goals.

With a financial plan tailored to your needs, you’re not just dreaming of a brighter future – you’re actively shaping it. A personalized financial plan can help you navigate towards your goals.

Custom-Tailored Approach for Every Need

Backed by a network of independent professionals, many of whom are CFPs (Chartered Financial Planners) or CPAs (Certified Public Accountants), you will receive a personalized touch. You are not stuck using a robot or financial software engine that provides computerized advice. We consider human emotions and personal needs.

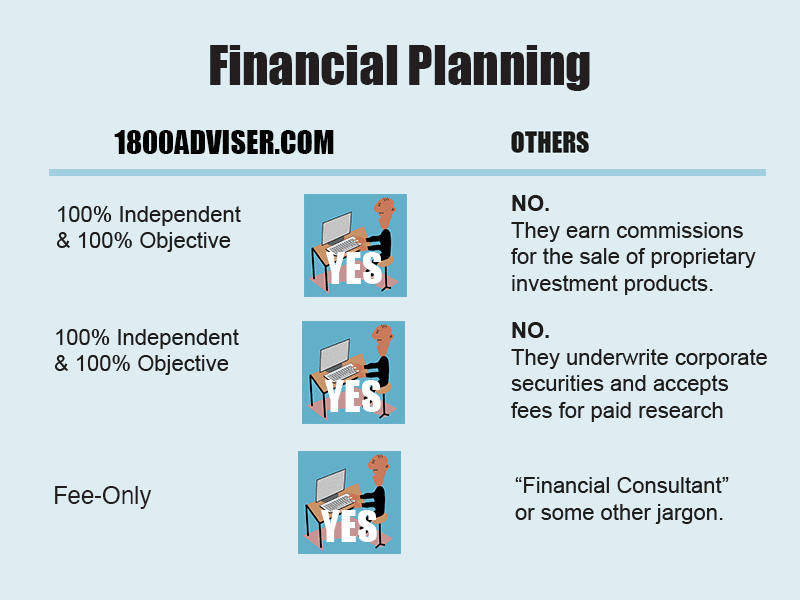

Whether you’re seeking comprehensive planning or modular advice on specific topics, our independent advisers tailor their services to match your level of sophistication and unique requirements. As 100% Independent and 100% Objective professionals, they offer unbiased advice free from the influence of commission-based product sales. This ensures you receive candid, transparent guidance that genuinely serves your interests.

Addressing Key Financial Questions

Advisers provide clear, concise answers to your pivotal financial questions, including but not limited to:

- Retirement readiness and lifestyle sustainability

- Adequacy of retirement savings and additional saving needs

- Feasibility of purchasing a second home or vacation property

- Longevity of retirement savings

- Estate taxation and planning strategies

- IRA types and investment decisions

- Social Security benefit optimization

- Medicare coverage options

- Necessity and structuring of wills and trusts

- Long-term care planning

- Estate tax minimization strategies.

A Comprehensive Strategy for Your Financial Well-being

Comprehensive financial planning goes beyond surface-level advice. It includes a personalized financial model, projecting ideal retirement expenses to determine your income needs. Estate and income tax rules are considered to optimize fund withdrawals from your accounts and ensure beneficiary designations and trusts are structured to minimize taxation.

Independent & Objective “Fee-Only” Advice

Professionals listed in the 1800ADVISER.COM directory are “Fee-Only,” and we consider them to be 100% Independent & 100% Objective™. In simpler terms, this means that these professionals do not charge commissions for their advice and are not incentivized to sell any particular products. Instead, their focus is on providing honest recommendations that are in your best interest.

Fair and Reasonable Pricing

Each independent professional sets their own pricing structure, with fees for comprehensive financial planning typically ranging from $1,000 to $5,000, depending on your unique circumstances. Some professionals may offer a full credit for this fee should you decide to continue with optional ongoing money management. Others may even offer it pro bono, or for free. Rest assured, all fees are clearly discussed and agreed upon in advance, in writing.

Free Consultations

Click here to ask us a question or schedule a FREE consultation. Alternatively, you can browse the biographies of our individual advisers on 1800ADVISER.COM. Choose the adviser that aligns with your financial aspirations and take the first step towards an empowered financial future.

All questions answered privately by email.

Connect with a Fee-Only financial planner, money manager, CPA or lawyer.

Sign up for TheAdviser.com Alert – a Trusted Buy-Side Research Newsletter For FREE!