Tax Returns & Planning

Tax season can be daunting, but with our comprehensive tax return and planning, it doesn’t have to be. We specialize in simplifying and optimizing the tax process for individuals and businesses alike, ensuring compliance and maximizing your financial benefits.

A Full Spectrum of Tax Services Tailored to You

- Diverse Tax Return Preparation: Whether you need assistance with federal, state, or local tax returns, our expert team is well-equipped to handle your requirements. We also provide specialized services for corporate tax returns including S-Corps, LLCs as well as trusts and estate returns, and more. This ensures that all your tax obligations are handled efficiently.

- Proactive Tax Planning: Navigating the complexities of tax laws requires foresight and strategy. Our tax planning services are designed to help you anticipate future tax liabilities and plan accordingly, minimizing your tax burden while staying compliant with current laws.

- Resolving IRS Issues and Audit Support: Facing IRS tax problems or audit concerns can be stressful. Our advisers are adept at navigating these challenges, offering expert guidance and support to resolve any issues swiftly and effectively.

Experienced Tax Assistance at Your Fingertips

Don’t let tax season be a source of stress. Our independent tax experts are designed to provide you tax return and planning services with peace of mind and financial efficiency. Whether you’re an individual seeking personal tax assistance or a business owner in need of corporate tax solutions, we’re here to help.

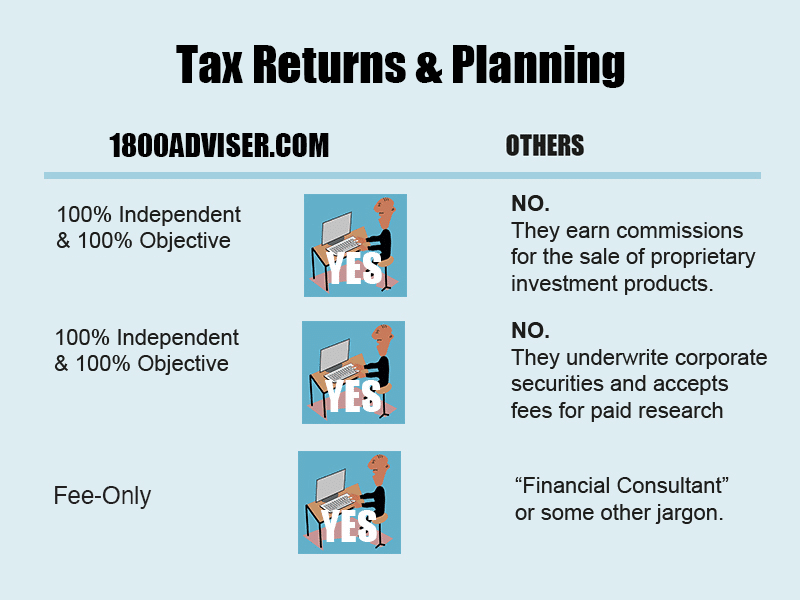

Independent & Objective “Fee-Only” Advice

The professionals featured in the 1800ADVISER.COM directory include Certified Public Accountants, IRS enrolled agents and tax attorneys who possess the expertise needed to navigate the intricacies of the IRS and State regulatory agencies. What sets these tax professionals apart is their unique access to a team of “Fee-Only” professionals that we consider to be 100% Independent & 100% Objective™. In simpler terms, this means that these professionals do not charge commissions for their advice and are not incentivized to sell any particular products. Instead, their focus is on providing honest recommendations that are in your best interest.

Fair and Reasonable Pricing

Each independent tax professional sets their own pricing structure, with fees for simple personal federal tax returns typically ranging from $200 to $400, with an additional $50 to $75 per state return. Business returns tend to be higher in costs, and if you require legal advice, the pricing will be determined based on the complexity of your specific situation. Rest assured, all fees are clearly discussed and agreed upon in advance, in writing.

Fair and Reasonable

Click here to ask us a question or schedule a FREE consultation. Alternatively, you can browse the biographies of our individual advisers on 1800ADVISER.COM. Choose the adviser that aligns with your financial aspirations and take the first step towards an empowered financial future.

All questions answered privately by email.

Connect with a Fee-Only financial planner, money manager, CPA or lawyer.

Sign up for TheAdviser.com Alert – a Trusted Buy-Side Research Newsletter For FREE!